Discovery Done Right: 5 Ways Knomee Makes Client Discovery Easier and Better for Financial Advisors

The more advisors I talk to, the more convinced I am that client discovery is broken. I could pull together a bunch of statistics for you (follow me on LinkedIn, I share them there all the time!), but I think one statistic tells the whole story:

While 90% of CFPs believe their recommendations are based on their clients’ goals, more than 51% of clients surveyed disagree

Think about that for a moment: The vast majority of advisors think they’re doing what their clients want, but more than half of their clients disagree.

Okay, so client discovery is broken, but is anyone really surprised?

Tech companies and consultants have enticed advisors with “personalization at scale” for decades. As my dear friend Mark Richards says, “it’s the language of broken promises in wealth.” In the quest for tech that drives growth through personalization, some advisors subscribe to up to 60 tech tools: lead gen, prediction & propensity models, web scrapers, risk tolerance, and retirement readiness. Rather than finding more time for personal connection with clients, they stretch themselves thinner, relegating discovery to a single meeting during onboarding.

Our mission at Knomee is to make discovery work better for advisors, clients, and prospects alike – without giving advisors a bunch of extra work. It wasn’t easy, but we are pretty proud of how it looks (not to mention a completion rate of more than 90%). Today, I want to share five ways that Knomee makes client and prospect discovery easier and better.

Here’s how:

1. Gamified wellness journeys

Knomee delivers personalized, gamified discovery adventures to clients and prospects that give you a deep, real-time understanding of their values, goals, and desires.

The best part? Knomee’s AI-powered, actionable insights help you know exactly how to start your next meeting with questions that reflect exactly what your client wants to talk about, in their own words.

Data from Knomee feeds directly into your CRM, giving everyone on your team the latest info on every client and prospect they encounter. So no matter how much your firm grows or how many clients each advisor serves, your team is never out of the loop.

In addition, Knomee suggests relevant discovery adventures based on an individual’s answers, helping them find more value out of the advisory experience..

2. Conversation starters for advisors

Advisors often struggle to ask questions that get to the heart of what’s on each client’s mind. When clients are asked open-ended questions like, “Is there anything you want to discuss?” they tend to forget important life events that an advisor should definitely know (e.g., divorce, new kid, job change).

With the data Knomee collects, the discovery process begins prior to the meeting, and your advisors are fueled with exactly what each client cares about most. Knomee’s AI synthesizes discovery data to surface the right questions, so clients feel known and advisors get the vital information they need.

Knomee turns discovery data into on-ramps for important, relationship-deepening conversations, which can easily and organically feed into upsell and cross-sell conversations.

3. Automatic client confidence meter

Advisors are often blind-sided when clients leave. When clients are unhappy about their relationship with their money, there is one place to turn. While the client may have been unhappy for a while, they never said anything to the advisor, either because they were uncomfortable doing so or they never felt like they had a chance.

That’s why we created a live client confidence meter that gives advisors a live view into client confidence, plus the ability to drill down to see changes in an individual client’s confidence. With all the ways technology keeps us connected, this one seems like a no-brainer, but you won’t find anything like it in any other tool.

4. Retention levers and smart tips

One of the top-rated features of Knomee is the “Retention Levers and Smart Tips” section, where we share behavioral insights about a client alongside psychological suggestions on how advisors can relate to the client in a way that builds confidence and trust.

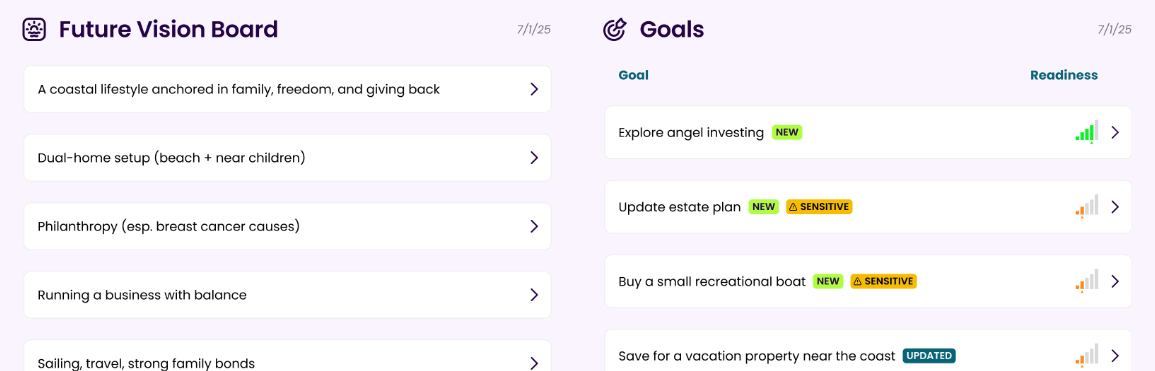

5. Real time client vision board and goals

Knomee frequently updates client profiles using the information gained through each Knomee Adventure, giving advisors a live look at any big changes that clients may be considering. In addition, Knomee rates the client’s perceived readiness to undertake their goals, giving your team a solid starting point for deeper engagement.

Do discovery right with Knomee

Discovery is the key to better conversion and retention, and that’s not going to change. When your clients feel like you know them, they tend to stick around – and send referrals your way.

That’s where Knomee comes in. Using Knomee with your clients is like turning on the faucet of client engagement. Once it’s on, you’ll notice a huge difference.

Click here to schedule a demo today.

Click here to see Knomee in action at our next quarterly Wealth Leadership Roundtable